In Pursuit of Patent Quality

If you informed any R&D executive that only 5% of their efforts may result in some value for their products, and any value they did create within that 5% would be worth the entire value of the company, there would be quite a few nervous R&D executives waiting to explain to the CTO why they are wasting so much of the company resources to generate so little.

Now, taking the same stance as patents, why is a 5% value acceptable? Is it lack of business drive to grow relevant IP, inability to execute on generating quality patents, or just acceptance of the “status-quo game of IP”?

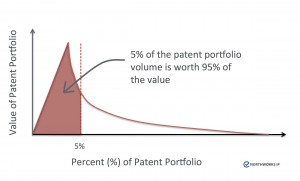

Research (and experience) validates that generally about 5% of a patent portfolio volume holds 95% or more of the value for a business. I would propose that the strategy of randomly filing patents based on generated ideas or shipped products actually generates even less value than 5%.

Here are some back of the envelope estimates as to why a random strategy will not generate any value, arguably close to 5%:

Taking some rough numbers and assume only 20% of a mature R&D organization’s ideas get turned into final products, and of that estimate generously that 50% would be protected by IP, that gives:

20% x 50% = 10% patent coverage of all possible generated ideas.

Now, again consider that only 5% of a portfolio has value, that gives:

10% x 5% = 0.5% patent coverage of all possible ideas generated by the venture have value.

It is fairly rough, and discounts a large number of variables, but is a simple way to illustrate that while a venture may believe they have 50% of their products protect by patents, in reality they only have about 0.5% of all possible ideas they generated protected by patents. Playing with the rough numbers will change the results slightly, but still give the same order of magnitude to consider. Next, and more importantly to consider, who is to say along the R&D process that out of all the ideas that were dropped, there did not exist most of the “valuable 5%” patents?

A good patent strategy still needs to have real market applicable patents that can be used to at least defend, license, or enforce.

This now begs the questions: Who in your venture is taking the cancelled product ideas, which may be dropped due to financial or resource issues, but have the potential to be future game changers? How early in the patent process is mining (and prosecution) happening? Fundamentally, where does IP execution happen in the business? If it starts – and finishes – at a product release, I would expect to be called into the CTO’s office and explain why I was wasting so much of the company resources to generate so little potential returns with IP.

Execution of a patent strategy to generate a high number of valuable patents has to have many points to mine ideas in the Innovation, R&D, and Product Release stages. With this type of model it affords the IP Manager, Legal, and CTO to be in a better position to ensure they can chose the best innovations to protect.