How IP Strategy makes you an Innovation Leader

Late last month BCG released The Most Innovative Companies (2014): Breaking Through is Hard to Do. The paper outlined the top 50 innovative companies of this year, and the trends they share. They report reinforces the five characteristics of strong innovators, one of which is how they leverage IP to exclude and build markets.

Rethinking your Innovation System

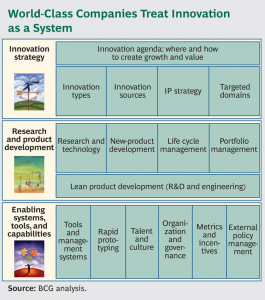

Another BCG Perspectives posting, Rethinking Your Innovation System (October 2014), builds on this and discusses how to approach Innovation as a System. The article describes the three major components of the system as “a strategy comprising choices on where and how to create growth and value through innovation; a supporting set of processes for research and product development; and an enabling set of systems, tools, and capabilities. (See the exhibit, ‘World-Class Companies Treat Innovation as a System.’)” It further goes into detail on how inside this Innovation Strategy there are four areas where value growth and creation can happen – Innovation Types, Innovation Sources, Targeted Domains, and IP Strategy. To me this demonstrates that to have a replicable innovative product there has to be much more depth in the process behind the ideas as a company grows.

Interestingly it also highlights the tangible number of IP assets have on the companies who develop breakthrough innovations on a consistent basis:

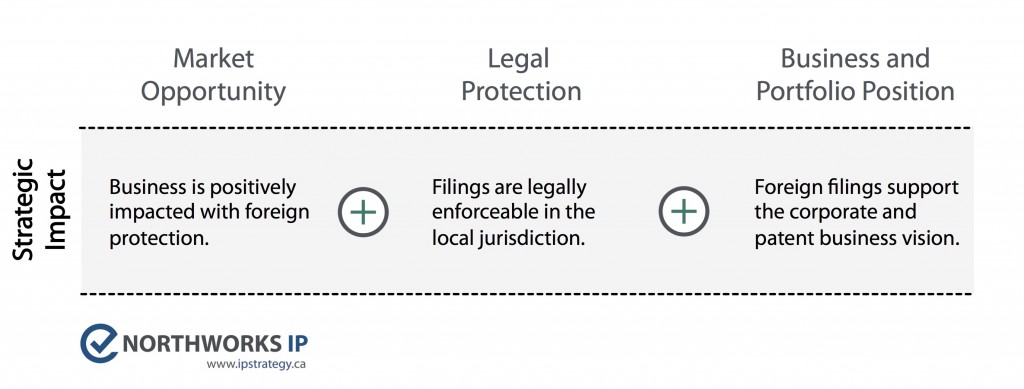

“Companies that manage their IP assets effectively are more successful than their competitors at winning approval for their applications, securing patents more than 60 percent of the time. They control a disproportionate share of the IP within their industries, measured not necessarily by raw numbers of applications and claims but by breadth and depth of coverage.” – BCG, Rethinking Your Innovation System.

Rethinking your IP System

Almost every startup or high growth venture I talk to or read about seems to want to emulate at least one of the companies on this list of 50. However few of them take the system level approach to growing their innovations, and even less of them have an institutionalized approach to IP strategy.

To move any venture into contention for this “Most Innovative Company” title in the future, they must first decide if they are going to embrace all components of the strategy, and with respect to IP ask the following questions:

- Do we have IP built into our operational and strategic processes?

- Do we let our patent portfolio manage the IP process, or does the IP vision drive the process and portfolio?

- Do we have the right team in place to deliver on the IP we need to own the breakthrough innovation R&D is producing?

Aligning an IP Strategy with a business strategy is inherently not difficult with the right team in place. It is, however, one critical piece consistent in the innovation system the current market leaders all have. So if you are going to emulate the market leaders and turn your venture into an Innovation Leader, you can’t pick and choose the pieces of the Innovation ecosystem you wish to use – it is all of them, including a defined IP strategy.