IP and Value Chains

Back in 2016 I wrote an IAM article on IP & Value chains, entitled “How an innovation and IP value-chain view can transform portfolio value“. In the article I talked about looking at an organizations value chain from the perspective of both depth and breadth, as it will give a more cohesive view of the landscape of the actual IP and innovation environment to build an IP strategy around.

This past month there was a published an article titled “Canada’s big, urgent economic priority is dynamic growth” (paywall enabled), where it talks about the how building an intangibles-rich economy is the key to success. The author notes that British and Dutch economics have found companies that have strong intangible assets capture much more of the value from “Global Value Chains”, and states that “The businesses that control the intangibles-intensive stages of global value chains will receive a disproportionate share of the gains as global value chains expand”.

The comments stem from the work of the 4 economists (Buckley, Strange, Timmer, and J. de Vries ) in the recently published Global Strategy Journal in their article entitled Rent appropriation in global value chains: The past, present, and future of intangible assets. The summary of their findings show that returns from intangibles are higher than returns from tangible assets (1.7x higher), and that effective management of intangibles is key to helping firms create and maintain competitive advantages in global markets.

I found it interesting that my “bottom up” business approach to building a strategy that takes into account complements and suppliers, the “top down” economic view maps this to rents related to the upstream / production stage / downstream stages of the global value chain address the same problem: ensuring deeper IP value is created and retained within firms. Further, both articles recognize the same thing: intangibles matter AND those companies or policy makers that have the foresight to place IP ownership in high rent areas of the value chain, will be rewarded in the future.

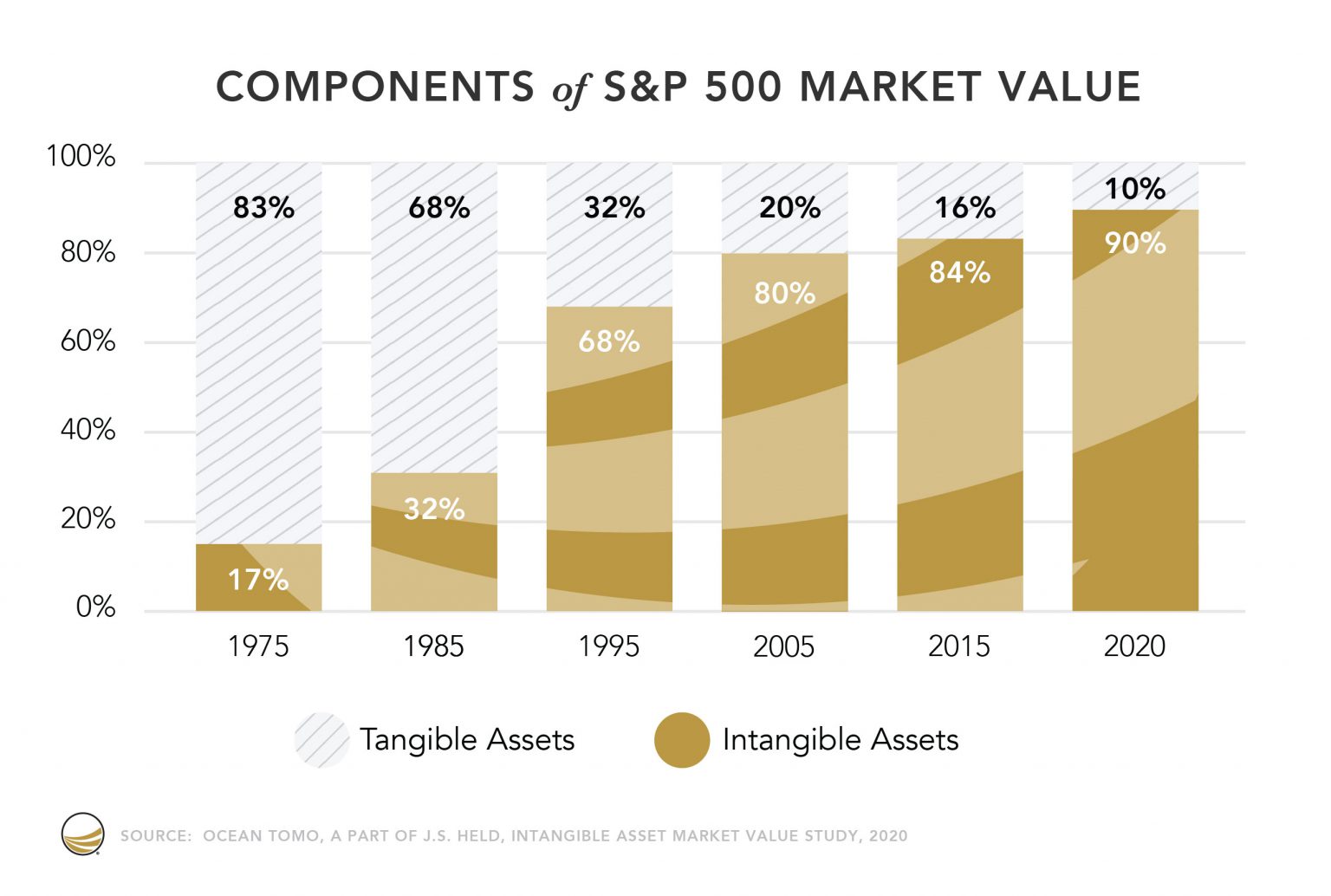

There is no denying that the value of intangibles as a component of corporate value are on the rise. The Ponemon Institute analyzed the value of intangible and tangible assets over nearly four and a half decades on the S&P 500 and found that in 2015 they make up 84% of all enterprise value on the S&P 500, a massive increase from just 17% in 1975. Newer data suggest it is now up to 90%. But as our approach to global business has changed since 1975, so has impact of where rents are found in global value chain.

To remain competitive, the articles (and others from the OECD similar to it) provides both background and support for companies, investors, and policy makers alike: intangible positions matter – both at the place we invest in, and the upstream / downstream position round around it.

For both policy makers and companies, our investment in a robust intangible position that covers the high rent areas will become an important area to cultivate over time. The result can be drivers of economic development for clusters or jurisdictions, and success for businesses in the form of increased market and financial growth.