This month I attended a PwC talk on the Global Tax Environment, where the IP issues around transfer tax were presented. The presenter, Elisabeth Finch, citing a Globe & Mail article “Global watchdogs take on the corporate tax dodgers” from September 2014, brought Tax and IP to life for the business ventures in the room by giving a tangible example on how transfer pricing and IP can impact a Canadian company:

“For example, let’s say a Canadian subsidiary of a foreign company sells widgets in Canada that it imports from its parent. And let’s say the patent for those widgets is held in a corporate affiliate in an offshore tax haven. The multinational tells the Canada Revenue Agency that its Canadian subsidiary had to pay a large licensing fee for the use of the patent. By making the fee as high as possible, that transfers money out of the Canadian subsidiary and into the affiliate in the tax haven. The result of this type of aggressive “transfer pricing” is less profit in Canada for CRA to tax. The OECD has proposed allowing tax authorities to take “special measures” to go beyond the “arm’s-length principle” and disallow tax benefits won with abuses of this kind.”

It brings light to an important point for small and growing companies – setting up the right infrastructure for IP, which includes planning for future IP tax positions, can avoid or mitigate some of the problems the widget company will experience as they grow.

But it’s not just hardware widget companies that need to consider this. PwC recently released an article entitled “3D printing: Potential tax issues facing industrial products companies” Technologies like 3D printing will have significant impacts on industrial products companies from a tax perspective – such as companies using 3D printing to reduce or shift how inventories are managed (print on demand), or how digital design are transferred or licensed to customers. This is a good example of how the IP and tax positions should be reviewed for many internationally growing ventures.

BUT….

Considering and finding the best tax position by planning of intangibles should be a factor in an IP strategy – there is a larger issue that tax shifts need to consider – the patent litigation defense.

In general transfer prices include IP license fees, and business structure must be setup to keep (as much as possible) the profits in the best jurisdiction. However, this type of pricing arrangement has potential to cause issues when enforcement of IP comes into play, specifically for patents. Andrew Blair-Stanek, via Dennis Crouch’s Patently Obvious, wrote about this issue earlier on in 2015 in an article titled “Transfer Prices Are an Evidentiary Gold Mine for Patent Defendants.” He confirms the point, that transfer prices set low for tax purposes could potentially impact lower future damages, or even go as far as help defendants fight injunctions. How can irreparable injury be shown if the transfer cost of IP was quantified at a low number? A great question.

Using IP to add bottom line value to your venture requires a view on the tax implications as well.

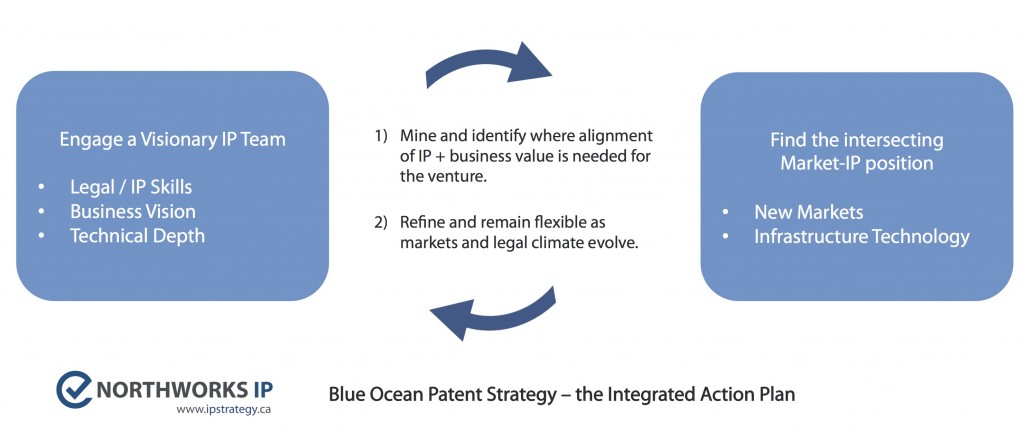

In sum: IP strategy is more than just filing patents in the right jurisdictions. It is more than business-useful claims. It is about positioning and integrating the IP in the business strategy and because the tax issues around IP are complex they need to be structured appropriately as a critical part of the business. This means structured both from the best tax/finance position, but also from future enforcement positions.

As a company plans to grow the longer term use of the IP – both how, when, and where it is projected to be used – need to be discussed by the team. It requires three minds to successfully create valuable IP: Business, Technical, and Legal. As part of the business team, the tax structure is a critical part of the success story.